Russian President Vladimir Putin appeared to have secretly handled almost $2 billion through banks and shell companies.

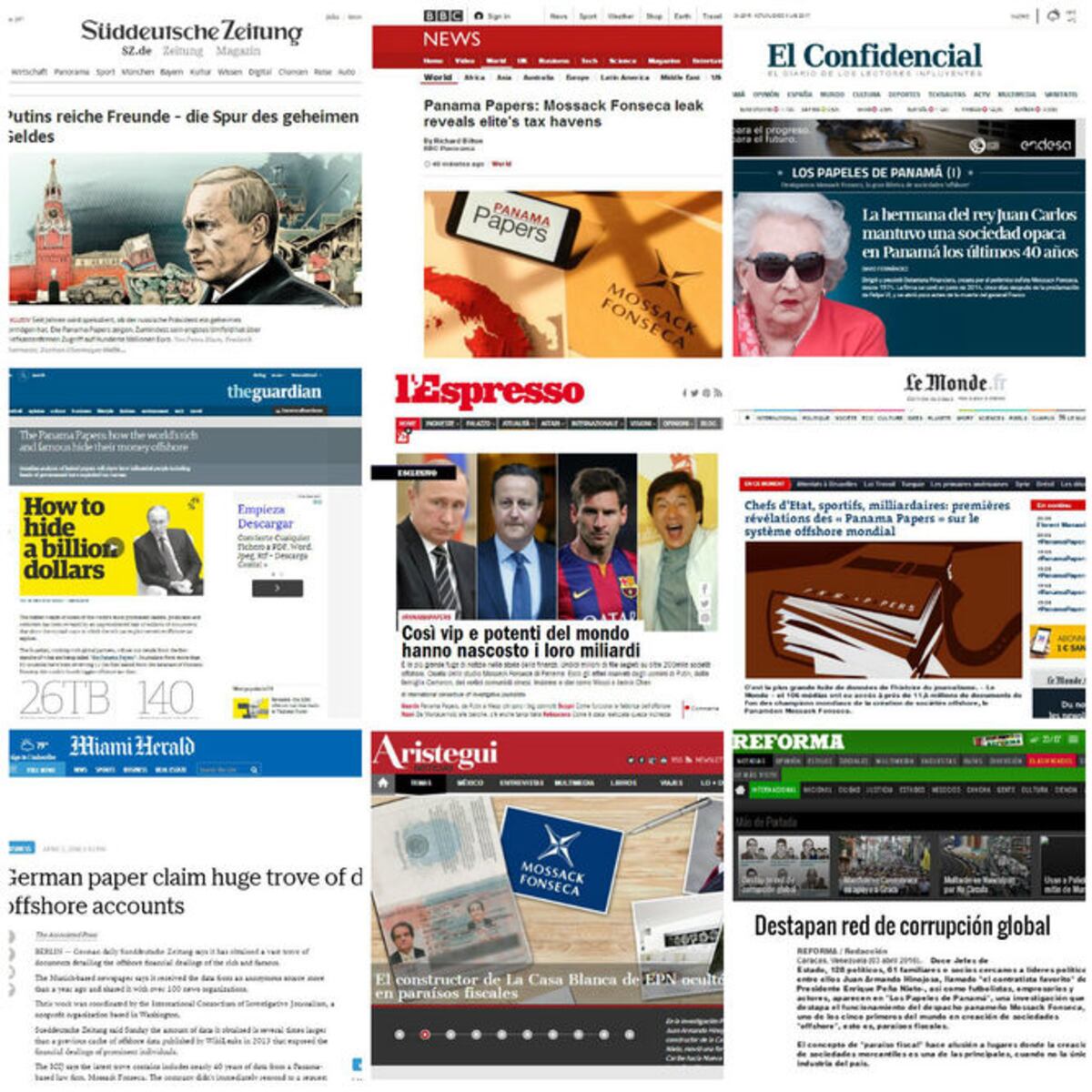

That information was obtained by the German daily Sueddeutsche Zeitung and shared with the International Consortium of Investigative Journalists (ICIJ), and also includes several other world leaders and former leaders.

The documents include details of financial transactions, hitherto unknown, of 128 politicians and officials around the world. It also reveals how many law firms and large banks sell financial instruments to politicians, fraudsters and drug dealers, the super wealthy and celebrities, including, sports stars.

The prime ministers of Iceland and Pakistan, the king of Saudi Arabia and the children of the president of Azerbaijan are other world figures who had allegedly controlled offshore companies, according to these documents. Also named are at least 33 people and companies that are on the blacklist of the US government for allegedly doing business with Mexican drug traffickers, terrorist organizations such as Hezbollah or nations under sanctions such as North Korea and Iran.

The US government said that one of the companies listed in the documents obtained by the newspaper could have supplied fuel to an aircraft used to bomb Syria and murder thousands of its citizens.

"These findings show how deeply rooted are harmful practices and crime in the offshore world," said Gabriel Zucman, an economist at the University of California, Berkeley and author of "The hidden riches of nations scourge of tax havens."

Zucman, who was informed of this investigation, added that publications should encourage governments to seek "targeted sanctions" against jurisdictions that enliven the secret offshore.

In the documents shared by the German newspaper with ICIJ, world leaders allegedly took advantage of offshore vehicles to commit acts of corruption or conceal their proceeds. The journalistic consortium said companies appear to be linked with the family of the senior leader of China, Xi Jingpin, who before taking over as president vowed to fight "against the armies of corruption."

It also includes Ukraine President Petro Poroshenko, who has identified himself as the reformer of a country shaken by corruption scandals. It also include new details of offshore transactions of the family of David Cameron, prime minister of Great Britain.

Most of the services provided by the offshore industry are legal. However, the documents that the German newspaper Sueddeutsche Zeitung accessed laid bare the activities of banks, law firms and other actors in this world that often have failed to comply with legal requirements created to confirm that their customers are not involved in criminal enterprises, tax evasion or political corruption.

Documents even reveal that certain brokers have hidden suspicious transactions and manipulated records to protect themselves and their clients.

According to the report, several of the largest banks worldwide, as UBS and HSBC, would be the real helmsmen behind the creation of difficult companies to track in the British Virgin Islands, Panama, Seychelles, Anguilla and the Bahamas, among others jurisdictions. The files contain more than 15,600 paper companies established by banks and other institutions for those customers who wanted to keep their finances secret.

Putin, for example, appeared to use banks to move money through transactions of up to $200 million to people in his inner circle. Partners, according to the ICIJ investigation, disguised payments, changed dates of documents and anonymously gained influence within the media and large automotive industries in Russia.

At a press conference, a spokesman for the Kremlin declined to answer questions about these actions. Instead, he accused the ICIJ of preparing an "information attack" against Putin and people close to him.

Documents obtained by German daily and shared with ICIJ come from the Panamanian firm Mossack Fonseca, which has branches or offices in Hong Kong, Miami, Zurich, the British Virgin Islands and more than thirty other countries.

The information contains data on 214,488 offshore entities linked to people in more than 200 countries, as well as the 21 financial jurisdictions where Mossack Fonseca is present.

The files link the Panamanian firm with companies or people linked to the diamond trade in Africa and the clandestine international art market, among others.

Another prominent client of the firm is the prime minister of Iceland, Sigmundur David Gunnlaugssson who, with his wife, allegedly acquired an offshore company that had bank bonds from Iceland during the financial crisis in that country.

It also mentions a convicted money launderer, who confessed to having made payments of $50,000 to the thieves in the Watergate case in the U.S.

The client portfolio of Mossack Fonseca also includes some of the people involved in a famous robbery in England and several of the players in the FIFA scandal.

The documents acquired by the ICIJ reveal that the Urugauy law firm of Juan Pedro Damiani, a member of the ethics committee of FIFA, has appeared to maintain business with three men involved in the scandal of this organization: the former vice president Eugenio Figueredo, Hugo Jinkis and Mariano Jinkis. The latter two, father and son, were accused of paying bribes in return for television rights to football matches in Latin America.

The consortium has information that the law firm is linked to a company linked to Jinkis and seven companies linked to Figueredo. In response to the findings of ICIJ, the FIFA ethics committee has begun an investigation into the relationship between Damiani and Figueredo.

The world's best player, Lionel Messi, and his father, appeared to own a company in Panama, Mega Star Enterprises. In Spain, Messi has been formally charged with evading taxes through offshore companies.

In addition, files held by the ICIJ show how the headquarters of its representation in Nevada tried to cover themselves and their customers from legal action by a district court in the United States by removing paper records of their office in Las Vegas and deleting electronic records of their phones and computers. The same documents would show that the firm had offered regularly to backdate documents in order to help their clients in their financial affairs.

"The allegations that we provide to shareholders structures supposedly designed to hide the identity of the real owners are totally unjustified and false," said the firm in response to questions submitted by the ICIJ.

The firm added that changing the dates of documents "is a well established and accepted practice," which is "common in our industry and its goal is not to cover or conceal illegal acts".

Mossack Fonseca declined to answer questions related to specific customers because of its obligation to maintain client confidentiality.

Ramón Fonseca Mora, cofounder of the firm, said in a recent interview on Panamanian television that they have no responsibility for what their clients do with the offshore companies they sell. He compared the practice with making cars, saying their responsibility ends once the car is produced.

According to him, blaming Mossack Fonseca for what people do with their companies would be like blaming the car factory "when a car is used in a robbery."

UNDER SCRUTINY

Mossack Fonseca operations have almost always been anonymous for people outside the world of offshore finance. However, in recent months they have been under increasing scrutiny, because some governments had partial leaks of the files. Authorities in Germany and Brazil, for example, have begun to investigate their practices.

Indeed, in February 2015, Süddeutsche Zeitung reported that Germany had conducted raids that had targeted one of its biggest banks, Commerzbank. The newspaper also reported to have opened an investigation of tax fraud in which in which the Panamanian firm would be involved.

In Brazil, Mossack Fonseca has been repeatedly mentioned in the investigation into alleged bribery and money laundering in the 'Lava Jato' operation, which have resulted in criminal investigations into political leaders, including former President Luiz Inacio Lula da Silva .

Brazilian prosecutors said the Panamanian firm qualifies as "major money launderers" and announced at that time that it would make criminal charges against five employees of the Brazilian representation of the firm. Mossack Fonseca, meanwhile, denies any wrongdoing in Brazil.

CRIME OF THE CENTURY

Before dawn on November 26, 1983, six thieves entered the Brink'sMat warehouse at Heathrow Airport in London. They tied up the security guards, doused with gasoline, lit a match and threatened to burn them, unless they open the vault. Inside there were about gold bars, diamonds and cash. "Thank you very much for your help. Have a Merry Christmas," said one of the thieves as he left. The British media called this 'The Crime of the Century.'

Most of the loot was never recovered, including the money generated by melting the gold and selling it. According to the German newspaper documents shared with ICIJ, a founder of Mossack Fonseca, Jürgen Mossack, may have helped to keep the money out of reach of the authorities.

Records appear to show that 16 months after the theft, the company established a company called Feberion Inc. in Panama for Gordon Parry, who allegedly laundered money for the Brink'sMat criminals.

According to documents, Mossack himself had figured in the company as one of the nominee directors, a term used in the offshore world to refer to who manages the company on paper, but which has no real authority over their activities.

The ICIJ information shows that in 1986, Mossack was aware that the company was apparently involved in handling stolen money from Brink'sMat.

"The company itself has not been illegally used, but it could be that the company had invested money through bank accounts and property that was illegally obtained," Mossack reportedly warned, according to documents delivered to ICIJ.

Records show that instead of helping the authorities to have access to goods, Feberion was apparently used as a measure that would have hampered the police investigation into the case. According to the ICIJ files, the firm would have issued 98 new shares after the authorities had obtained two original actions.

In 1995, three years after Parry was sentenced to a decade in prison for his role in the theft of gold, Mossack Fonseca would have ended their business relationship with Feberion.

A spokesman for the firm said any allegation that the firm helped these criminals is "completely false."

He added that Jürgen Mossack had no relationship with Parry, and that police never contacted the firm about it.

Indeed, the offshore system depends on the expansion of the industry bankers, lawyers, accountants and other intermediaries, who must protect the identities of their clients. Often such protection helps disguise dirty money by creating corporations, trusts and other entities.

The measures taken by Mossack Fonseca in Feberion case would have included use services firm based in Panama, through society Chartered Management Company, directed by Gilbert Straub, so that they will provide new directors of the company following the resignation Mossack.

According to Robert Mazur, a former narcotics agent, Straub was captured in the United States in a raid by the Drug Enforcement Administration (DEA, for its acronym in English). It was then that he confessed his guilt in money laundering. He also revealed how illegal funds were channeled to the reelection campaign of President Richard Nixon in 1972.

In its response to the ICIJ, Mossack Fonseca said that it follows "both the letter and the spirit of the law. Therefore, in almost 40 years of operation we have not been charged with criminal acts."

The firm Mossack Fonsecafrom its founding by Jürgen Mossack, lawyer of German descent, and Ramón Fonseca Mora, novelist and presidential advisor to two governments. According to the records ICIJ handles, the firm has worked with major banks and law firms in the Netherlands, Mexico, United States and Switzerland, whose purpose would be to help its customers to move money or reduce their tax bills.

According to an analysis by the consortium, more than 500 banks and their subsidiaries have worked with Mossack Fonseca in the creation and administration of offshore companies.

Mossack Fonseca says its intermediaries are their real clients, and not the final customers, which are who really use these offshore entities. In addition, the company has indicated that these intermediaries are additional layers of oversight for the review (due diligence) of new customers. Regarding procedures, Mossack Fonseca said that often exceed these "existing rules and standards which we and others are forced" to fulfill.

SECRETS AND VICTIMS

Kgopa Nick's father died when Nick was 14 years old. The companions of his father in the gold mine where he worked in South Africa, claimed that he had died from exposure to chemicals.

Nick, his mother and younger brother, who is deaf, survived thanks to the monthly checks from a fund for widows and orphans of miners.

But one day, the payments stopped coming.

Nick's family was one of many who lost their pensions due to fraud investment fund, for $60 million, have perpetrated South African businessmen. According to judicial investigations at the time, a company handling goods, Fidentia, was responsible for the looting of millions of the investment fund, including the death benefits of mining and protected more than 46,000 widows and orphans.

The authorities managed to arrest Graham Maddock for his participation in the fraud, through Fidentia.

According to the documents to which access had ICIJ, Maddock would have paid Mossack Fonseca $59,000 between 2005 and 2006 to set up offshore companies, including one called Fidentia North America. The Panamanian firm said it will provide "VIP service" to the client, as appears in the documents submitted to ICIJ.

Records obtained by the newspaper Sueddeutsche Zeitung from Mossack Fonseca appear to show that the firm created offshore structures for Steve Goodwin, reported by the South African authorities as one of the major players in the Fidentia case. Goodwin even reportedly met with lawyers from the Panamanian firm in a luxury hotel in New York. According to the files, both allegedly spoke "deeply" about the scandal, and the lawyer of the firm is said to have "persuaded" Goodwin to better protect the assets through offshore companies.

The lawyer said that Goodwin told him he was not involved in the scandal "in any way" and that he was only "a victim of circumstances". Goodwin is still serving a sentence of 10 years in South Africa, after pleading guilty to fraud and money laundering, when he was arrested in 2008 in Los Angeles.

Goodwin's arrest would have generated reactions within the firm, according to ICIJ. One of the lawyers apparently proposed to have an accountant "prepared" to "prevent prosecutors from taking action against the companies behind Hamlyn Property LLP", which belonged to Goodwin. This is one of the many scandals in which the firm has been involved, which include a case in Indonesia where small investors complained that a company registered by Mossack Fonseca in British Virgin Islands was used to steal about $150 million from more than 3,000 people.

One of those investors contacted the firm in 2007.

"We really need our money to pay tuition for the education of our children this April," he said. He knew of the existence of the firm after seeing his name in the brochure announcing it as investor funds.

Mossack Fonseca did not answer questions related to its relationship with Goodwin submitted by the ICIJ.

On February 10, 2011, a company registered in British Virgin Islands, named Sandalwood Continental Ltd., appeared to loan $200 million to a similar entity called Horwich Trading Ltd., based in Cyprus.

The next day, Sandalwood assigned the rights to receive payments on the loan, including interest, to Ove Financial Corp., a British Virgin Islands company. According to documents in the hands of the ICIJ, Ove would have paid $1 for those rights.

On the same day, Ove reallocated their rights to collect the loan to a Panamanian company called International Media Overseas. It also paid $1 for those rights. In 24 hours, the loan would have been transferred to three countries, two banks and four companies, a process that usually hinders asset tracking.

The footprint of the loan revolved around people linked with Russian President Vladimir Putin. The Rossiya Bank, based in St. Petersburg, institution whose majority owners and presidents have been called the "tellers" Putin was the one who created Sandalwood Continental.

International Media Overseas, which allegedly would have ended interest payments of $200 million would be controlled by Sergey Roldugin, classical violinist and godfather of the eldest daughter of Putin.

The loan for $200 million was one of dozens of transactions related to funds totaling at least $2 billion, whose track would rest in the files obtained Süddeutsche Zeitung on the signing Mossack Fonseca, and that would involve individuals and companies linked to Putin.

Through them, the Rossiya Bank would have obtained the majority of the shares of the largest truck manufacturer in Russia and also have dabbled in the business of media.

Payments made by people close to Putin could even be considered as part of the payment for contracts with the Russian state. The documents suggest that most loan money came from a bank in Cyprus, whose main shareholder at the time was the VTB Bank, controlled by the Russian state.

At a press conference last week, Putin's spokesman, Dmitry Peskov, said the government would not respond to questions from ICIJ because they were questions that had been made "hundreds of times and answered hundreds of times." Peskov said Russia is "provided with the necessary legal arsenal at national and international level to protect the honor and dignity of our president."

In theory, national laws and international agreements should regulate that firms such as Mossack Fonseca are pending your customers may be involved in money laundering, tax evasion, or any other unlawful act. These regulations require special attention to the 'Politically Exposed Persons (PEP)', which includes officials and their families. When someone happens to be a PEP, it is expected that the intermediary that creates their companies carefully check their activities to ensure that they are not involved in corruption.

Mossack Fonseca told ICIJ that they have the "duly established policies and procedures to identify and manage cases in which individuals are to be classified as PEP or are related to these."

However, the information handled by ICIJ show that the Panamanian firm may not be as rigorous in this area as they claim. An internal audit in 2015 showed that Mossack Fonseca had knowledge about the identities of the true owners of only 204 of the 14,086 companies that had incorporated in the Seychelles, located in the Indian Ocean.

In the British Virgin Islands, Mossack Fonseca also have had difficulties. Authorities in the Caribbean island have fined the firm $37,500 for allegedly violating antimoney laundering standards for a company linked to the son of Egyptian president Hosni Mubarak, after both were charged with corruption his country.

"Our formula for risk assessment is seriously flawed," concluded an internal review.

ICIJ analysis on the documentation from the firm concludes that it had 58 relatives and associates of prime ministers and world leaders within its customer base.

Records show, for example, that relatives of President of Azerbaijan Ilham Aliyev apparently used foundations and companies in Panama to keep secret investments in gold mines and real estate in London.

The children of Pakistani Prime Minister Nawaz Sharif also owned real estate in London through entities created by Mossack Fonseca.

The family members of at least eight current or former members of the Politburo Standing Committee of China, the country's main regulatory authority, his credit would offshore companies created by Mossack Fonseca. Within this list is the brother of President Xi, who would have established two companies in the British Virgin Islands in 2009.

Representatives of Azeri, Pakistani and Chinese did not respond to questions he sent ICIJ them.

The current president of Argentina, Mauricio Macri, is also included in the list of world leaders who have used Mossack Fonseca to establish offshore entities. Macri, according to ICIJ documents, would have been the director and vice president of a company in the Bahamas, managed by Mossack Fonseca during his time as mayor of the Argentina capital. A spokesman for the president said that the ruling was never personally own shares in this company, which was part of their family businesses.

INVASION

In 2014, during the Russian invasion of Ukraine, President of Ukraine Petro Poroshenko managed to gather the necessary documents to create a company in the British Virgin Islands, according to ICIJ documents. Poroshenko spokesman said the creation of the company had nothing to do with "any political or military event in Ukraine." Financial advisers Poroshenko, meanwhile, said the president had not included the BVI company in its 2014 financial statement because neither company nor the two he owns in Cyprus and the Netherlands, had no property.

They added that the companies were part of the corporate restructuring to help sell the confectionery company owned by Poroshenko.

The current Prime Minister of Iceland, Sigmundur David Gunlaugsson, also appears in the data ICIJ. Upon entering the parliament of his country, in 2009, he and his wife have shared ownership of an offshore company in the British Virgin Islands. Months later, he would have sold his shares to his wife for $1.

The company had in its portfolio a series of bonds originally were worth millions of dollars in three large Icelandic banks that went bankrupt during the global financial crisis of 2008, so that the Icelandic politician was their bankruptcy creditor. During the last year of his government, Gunnlaugsson announced an agreement with creditors. He did not announce, however, the financial involvement of his family in the deal.

In recent days, Gunnlaugsson has denied that the financial interests of his family had influenced his stance. He has not made it clear if his political positions benefited or hurt the values of bonds held by the offshore company.

During an interview with Reykjavic Media, a partner in ICIJ, Gunnlaugsson denied hiding assets. Confronted with the name of the offshore company linked to him Wintris Inc. the prime minister said: "I'm starting to feel a little strange with these questions, because it seems as if you were accusing me of something."

Shortly thereafter, the president ended the interview.

Within days, his wife addressed the issue in a public note on Facebook, which claimed that the company was hers and not her husbands, and that she had paid all applicable taxes.

Since then, members of the Parliament of Iceland have questioned Gunnlaugsson about why he never revealed the existence of society. They have even asked him to resign his office.

The prime minister has tried to defend himself with a statement of eight pages, which claims that he had no obligation to make his link to Wintris public, since his wife was the one who really owned the company.

DISCOVERING OFFSHORE

In 2005, a tour boat named Ethan Allen sank on Lake George, New York. 20 elderly tourists drowned. After the survivors and relatives of the dead interpose a claim, they learned that the tour company did not have insurance, because a fraudster had sold them a false policy.

Irvin Boncamper Malchus, an accountant on the island of St. Kitts and Nevis, pleaded guilty in US court in 2011, to help launder money from this fraud, and others.

According to information obtained by the ICIJ, Boncamper was known to Mossack Fonseca, he would have served as a figurehead nominee director to some 30 companies created by the firm.

On hearing the sentence handed down to Boncamper, the firm would have ordered remove as director of the companies in which he appeared and changed the dates of his removal to appear that the action had been taken a decade earlier.

It would not be the first time that relates to Mossack Fonseca with such practices. In the case of "Operation Lava Jato 'in Brazil, prosecutors alleged that employees of the firm destroyed and hid documents in an earlier case to cover up his involvement in a case investigated years ago.

A document obtained by the police indicated that in that case an employee of the signing of the Brazil office sent an email instructing his subordinates to hide the evidence. "Do not leave anything. I will keep it in my car or my house."

ICIJ data, meanwhile, show that something very similar happened in Nevada in 2014. According to the data, employees of Mossack Fonseca would have hidden the link between the headquarters of the firm in Las Vegas and the headquarters in Panama due to an order of a US court requesting delivery of information on 123 companies incorporated by Mossack Fonseca in that jurisdiction.

The companies in question have been linked by prosecutors in the corruption scandal Argentina on a person close to the former presidents Nestor Kirchner and Cristina Fernandez de Kirchner.

In an effort to disassociate itself from US jurisdiction Mossack Fonseca said the Las Vegas office was not a branch, but an independent office.

ICIJ documents, however, would show the opposite. These indicate that they would have

controlled the bank account based in Las Vegas and the partners of the firm would own 100 percent of this office. The firm would then managed several steps to remove documents from the branch and all traces that could link. They have asserted that the branch manager would be very "nervous" and that for that reason, researchers could discover that "we are hiding something."

Mossack Fonseca declined to answer questions related to issues of Nevada and Brazil, but generally refused to obstruct the investigations or cover improper activities.

"It is our policy not to hide or destroy documents that could be used in any investigation or proceeding pending" they said.

REFORM OF A SECRET WORLD

In 2013, British Prime Minister David Cameron urged the territories of his country abroad, including British Virgin Islands to join forces and thus "put the house in order", and join the fight against tax evasion and the secret offshore.

ICIJ documents show that the politician's own family could have taken advantage of this system.

Ian Cameron, billionaire stockbroker and late father of Prime Minister was Mossack Fonseca client, and would have used the firm to hide its investment fund, Blairmore Holdings Inc., and avoid paying taxes.

The name of the entity funds came from Blairmore House, where he lived and part of the Cameron family grew up. Mossack Fonseca would have recorded the entity in Panama, although most of its key investors were British. Ian Cameron would have controlled the funds from the creation of the company in 1982 until he died.

The Panamanian firm would have used untraceable ownership certificates, known as bearer shares, nominative and official employee domiciled in Bahamas to meet the objectives for which the entity was created.

The story of Ian Cameron fund is one of the examples illustrating how the secret offshore deeply penetrates the lives of politicians and financial elites around the world, making it difficult fiscal reforms in these jurisdictions.

In the United States, for example, states such as Delaware and Nevada, which have allowed company owners are anonymous, continue to fight efforts to require greater corporate transparency.

In April 2013, after ICIJ release information 'Offshore Leaks', based on confidential documents from British Virgin Islands and Singapore, some customers Mossack Fonseca would have contacted the firm in order to guarantee that their assets were safe from public scrutiny.

Mossack Fonseca had then told their clients that they should not worry. They have ensured that their commitment to the privacy of its customers "has always been paramount, and that in this respect the confidential information is stored in a data center advanced, and that any information within our global network is managed through encrypted algorithms that meet the highest world standards".

This story was reported and written by Bastian Obermayer, Gerard Ryle, Marina Walker Guevara, Michael Hudson, Jake Bernstein, Will Fitzgibbon, Mar Cabra, Martha M. Hamilton, Frederik Obermaier, Ryan Chittum, Emilia Díaz-Struck, Rigoberto Carvajal, Cécile Schilis-Gallego, Matthew Caruana-Galizia, Miguel Fiandor and Mago Torres.